What Is The Sales Tax On A Vehicle In Massachusetts . The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. calculating massachusetts car sales tax: The sales tax on a vehicle purchase in. what is the sales tax on a car purchased in massachusetts? Input the amount and the. according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. Massachusetts has a fixed motor vehicle excise rate that's $25 per. use our simple sales tax calculator to work out how much sales tax you should charge your clients. if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%.

from formspal.com

use our simple sales tax calculator to work out how much sales tax you should charge your clients. according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. Massachusetts has a fixed motor vehicle excise rate that's $25 per. The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. calculating massachusetts car sales tax: The sales tax on a vehicle purchase in. Input the amount and the. what is the sales tax on a car purchased in massachusetts? if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car.

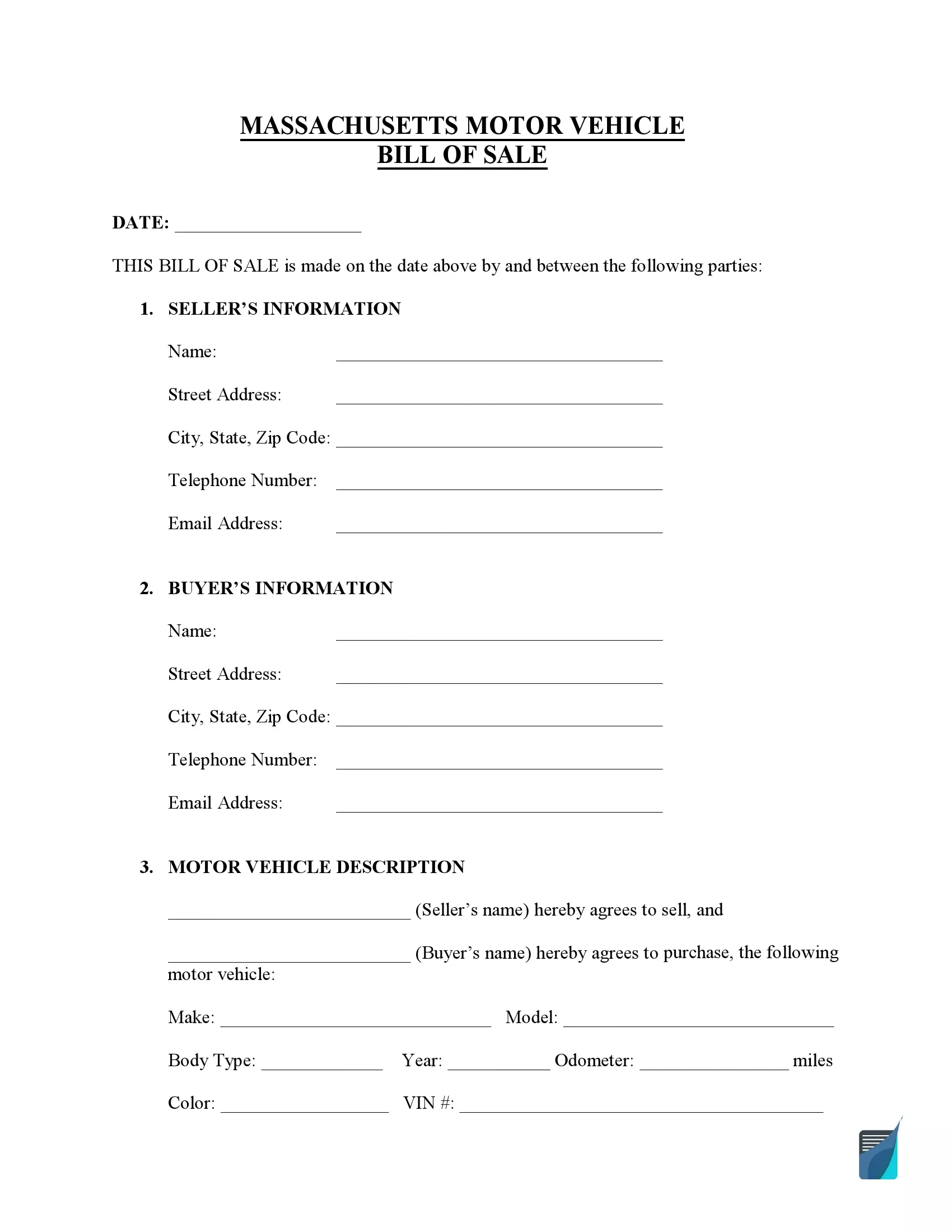

Free Massachusetts Bill of Sale Forms (PDF) FormsPal

What Is The Sales Tax On A Vehicle In Massachusetts in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. use our simple sales tax calculator to work out how much sales tax you should charge your clients. if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. Massachusetts has a fixed motor vehicle excise rate that's $25 per. what is the sales tax on a car purchased in massachusetts? Input the amount and the. calculating massachusetts car sales tax: The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. The sales tax on a vehicle purchase in.

From learn.financestrategists.com

Accounting for Sales Tax Definition, Explanation & Examples What Is The Sales Tax On A Vehicle In Massachusetts vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new. What Is The Sales Tax On A Vehicle In Massachusetts.

From www.wwlp.com

A guide to your annual motor vehicle excise tax WWLP What Is The Sales Tax On A Vehicle In Massachusetts Massachusetts has a fixed motor vehicle excise rate that's $25 per. Input the amount and the. what is the sales tax on a car purchased in massachusetts? The sales tax on a vehicle purchase in. vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. use. What Is The Sales Tax On A Vehicle In Massachusetts.

From tuscontables.com

≫ Uso comercial del vehículo Deducciones Fiscales What Is The Sales Tax On A Vehicle In Massachusetts if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. calculating massachusetts car sales tax: use our simple sales tax calculator to work out how much sales tax you should charge your clients. in general, sales tax in massachusetts is 6.5 percent and. What Is The Sales Tax On A Vehicle In Massachusetts.

From printablebillofsale.org

Free Massachusetts Motorcycle Bill of Sale Form Download PDF Word What Is The Sales Tax On A Vehicle In Massachusetts The sales tax on a vehicle purchase in. The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. use our simple sales tax calculator to work out how much sales tax you should charge your clients. calculating massachusetts car sales tax: Massachusetts has a fixed motor vehicle excise rate that's $25. What Is The Sales Tax On A Vehicle In Massachusetts.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation What Is The Sales Tax On A Vehicle In Massachusetts calculating massachusetts car sales tax: Input the amount and the. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. The sales tax on a vehicle purchase in. Massachusetts has a fixed motor vehicle excise rate that's $25 per. what is the sales tax on. What Is The Sales Tax On A Vehicle In Massachusetts.

From legaltemplates.net

Massachusetts Motorcycle Bill of Sale Legal Templates What Is The Sales Tax On A Vehicle In Massachusetts vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. The sales tax on a vehicle purchase in. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. The massachusetts sales tax is 6.25% of. What Is The Sales Tax On A Vehicle In Massachusetts.

From www.nbcnews.com

States working harder to collect online sales taxes What Is The Sales Tax On A Vehicle In Massachusetts The sales tax on a vehicle purchase in. The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. Input the amount and the. vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. what is the sales tax on a. What Is The Sales Tax On A Vehicle In Massachusetts.

From templates.rjuuc.edu.np

Bill Of Sale Template Ma What Is The Sales Tax On A Vehicle In Massachusetts calculating massachusetts car sales tax: if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. The sales tax on a vehicle purchase. What Is The Sales Tax On A Vehicle In Massachusetts.

From ar.inspiredpencil.com

Motor Vehicle Bill Of Sale What Is The Sales Tax On A Vehicle In Massachusetts use our simple sales tax calculator to work out how much sales tax you should charge your clients. The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. Massachusetts has a fixed motor vehicle excise rate that's $25 per. in general, sales tax in massachusetts is 6.5 percent and calculating sales. What Is The Sales Tax On A Vehicle In Massachusetts.

From esign.com

Free Massachusetts Motor Vehicle Bill of Sale Form PDF What Is The Sales Tax On A Vehicle In Massachusetts Input the amount and the. according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. calculating massachusetts car sales tax: use our simple sales tax calculator to work out how much sales tax you should charge your clients. Massachusetts has a fixed motor vehicle excise rate that's $25 per. what is. What Is The Sales Tax On A Vehicle In Massachusetts.

From legaltemplates.net

Free Massachusetts Bill of Sale Forms Printable PDF & Word What Is The Sales Tax On A Vehicle In Massachusetts calculating massachusetts car sales tax: in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a new car. what is the sales tax on a car purchased in massachusetts? The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. vehicles. What Is The Sales Tax On A Vehicle In Massachusetts.

From forms.legal

Download Bill of Sale Massachusetts For Vehicle or General Sale What Is The Sales Tax On A Vehicle In Massachusetts according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. calculating massachusetts car sales tax: The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. use our simple sales tax calculator to work out how much sales tax you should charge your clients. Massachusetts has. What Is The Sales Tax On A Vehicle In Massachusetts.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax What Is The Sales Tax On A Vehicle In Massachusetts The sales tax on a vehicle purchase in. vehicles purchases are some of the largest sales commonly made in massachusetts, which means that they can lead to a hefty. calculating massachusetts car sales tax: The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. Input the amount and the. use. What Is The Sales Tax On A Vehicle In Massachusetts.

From www.signnow.com

Massachusetts Resident Tax Return Form 1 Mass Gov Fill Out and What Is The Sales Tax On A Vehicle In Massachusetts if the sale is made by a motor vehicle or trailer dealer or lessor who is registered, the sales tax rate is 6.25%. The massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property. Input the amount and the. calculating massachusetts car sales tax: Massachusetts has a fixed motor vehicle excise rate. What Is The Sales Tax On A Vehicle In Massachusetts.

From billofsale.net

Free MassDOT RMV (Registry of Motor Vehicles) Auto Bill of Sale Form What Is The Sales Tax On A Vehicle In Massachusetts according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. what is the sales tax on a car purchased in massachusetts? calculating massachusetts car sales tax: Massachusetts has a fixed motor vehicle excise rate that's $25 per. Input the amount and the. The massachusetts sales tax is 6.25% of the sales price. What Is The Sales Tax On A Vehicle In Massachusetts.

From www.template.net

Massachusetts Bill of Sale For Car Template Google Docs, Word, PDF What Is The Sales Tax On A Vehicle In Massachusetts The sales tax on a vehicle purchase in. use our simple sales tax calculator to work out how much sales tax you should charge your clients. Massachusetts has a fixed motor vehicle excise rate that's $25 per. according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. what is the sales tax. What Is The Sales Tax On A Vehicle In Massachusetts.

From www.vrogue.co

Bill Of Sale For Car Massachusetts Fill Out Sign Onli vrogue.co What Is The Sales Tax On A Vehicle In Massachusetts calculating massachusetts car sales tax: what is the sales tax on a car purchased in massachusetts? use our simple sales tax calculator to work out how much sales tax you should charge your clients. Massachusetts has a fixed motor vehicle excise rate that's $25 per. in general, sales tax in massachusetts is 6.5 percent and calculating. What Is The Sales Tax On A Vehicle In Massachusetts.

From www.formsbirds.com

Car Tax Application Form Massachusetts Free Download What Is The Sales Tax On A Vehicle In Massachusetts calculating massachusetts car sales tax: Input the amount and the. what is the sales tax on a car purchased in massachusetts? according to salestaxhandbook, massachusetts has a state sales tax rate of 6.25% on all cars. in general, sales tax in massachusetts is 6.5 percent and calculating sales tax is relatively simple when you're buying a. What Is The Sales Tax On A Vehicle In Massachusetts.